Get the free lien release letter

Show details

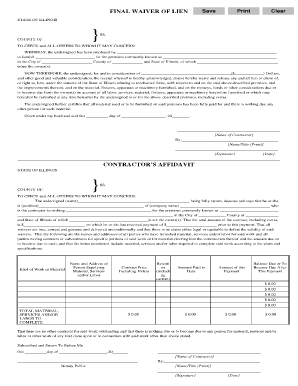

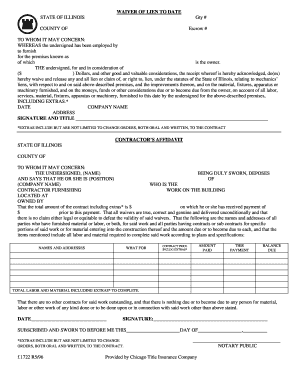

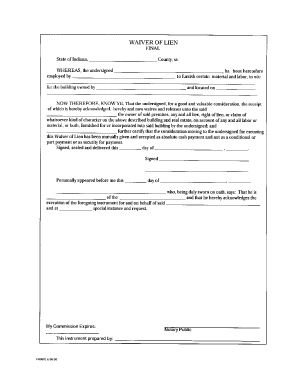

FINAL WAIVER OF LIEN STATE OF ILLINOIS COUNTY OF COOK SS Gty Loan TO WHOM IT MAY CONCERN WHEREAS the undersigned has been employed by to furnish for the premises known as of which is the owner. The undersigned for and in consideration of Dollars and other good and valuable consideration the receipt whereof is hereby acknowledged do es hereby waive and release any and all lien or claim of or right to lien under the statutes of the State of Illinois relating to mechanics liens with respect to...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lien release form

Edit your illinois lien release form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lien release letter illinois form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing lien clearance letter online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit lien release letter for car form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

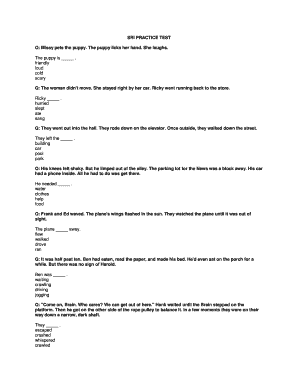

How to fill out lien satisfaction letter form

How to fill out release of lien form:

01

Obtain the necessary form: Start by acquiring the specific release of lien form from the appropriate source, which can vary depending on the jurisdiction and the nature of the lien. This may include downloading it from a government website or obtaining it from a legal professional.

02

Provide relevant information: Fill in all the required fields on the form accurately and completely. This typically includes details such as the name and contact information of the lienholder, the name of the debtor or property owner, the date the lien was filed, and the amount of the lien.

03

Include additional details, if necessary: Depending on the circumstances, there might be sections or fields on the form that require additional information. This could include explaining the reason for releasing the lien or providing any supporting documentation that may be required.

04

Sign and date the form: Ensure that all required signatures are obtained. This typically includes signatures from both the lienholder and the debtor or property owner. Additionally, make sure to date the form accurately.

05

File the completed form: Once the form is properly filled out and signed, it should be filed with the appropriate entity or agency as instructed on the form. This may involve submitting it to a government office or recording it with the county clerk's office.

Who needs release of lien form:

01

Individuals or businesses who have previously placed a lien on a property or asset and now wish to release that lien.

02

Property owners or debtors who have satisfied their obligations or resolved the issues that led to the placement of the lien and need to have the lien officially released.

03

Legal professionals or title companies who handle real estate transactions and need to ensure that all liens on a property are properly released before transferring ownership.

In summary, anyone who has a legal interest in a property or asset and wishes to release a previously filed lien should use a release of lien form. This document helps to officially remove the lien and establish clear ownership or financial obligations.

Fill

a lien clearance letter in that confirms the lien release

: Try Risk Free

People Also Ask about car lien release letter

Do lien waivers need to be notarized in Illinois?

Notarization Not Required Illinois lien waivers are not required to be notarized in order to be effective.

How do I file a notice of lien in Illinois?

Under Illinois law, a mechanics lien should be filed in the County Recorder of Deeds where the property is located. This is crucial as the lien must be filed not only in the correct county but the correct office as well. The fees and specific document formatting vary depending on your county.

Can a contractor file a lien without a contract in Illinois?

Contractors, as well as subcontractors and material suppliers can file an Illinois construction lien. If a company does not have a contract with the owner or with the contractor, they are not eligible to file an Illinois mechanics lien claim.

Which type of lien waiver is best for property owners?

Once an unconditional lien waiver is signed, it is fully effective and enforceable. While using an unconditional lien waiver will certainly protect your property, it won't guarantee that the signor actually receives payment, since unconditional waivers are typically enforceable even if signor never gets paid.

What is a conditional waiver of lien Illinois?

This il final conditional waiver (also called a final conditional lien release) should be used when the final payment for a project is expected but has yet to be received on a project in the state of il. Signing this waiver signifies that no further payments are expected following the payment described in the waiver.

How much does it cost to file a lien in Illinois?

WHAT MUST I DO BEFORE I FILE MY LIEN? Usually there is at least one notice that you must mail before you can file your lien. These notices are sometimes called notices of intent to file lien. Illinois Document Preparation fee of $165 includes all required notices of intent.

Do lien waivers need to be notarized in Indiana?

Indiana lien waivers are not required to be notarized, and notarization just slows down the process.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit to fill out a lien the lien has been satisfied from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your vehicle auto lien release letter into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send car lien release form to be eSigned by others?

When your what is a lien release letter is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit lien release letter template on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute lien release letter example from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is lien clearance letter illinois?

A lien clearance letter in Illinois is a document issued by a lien holder confirming that a debt secured by a lien has been paid off and that the lien has been released on the property.

Who is required to file lien clearance letter illinois?

Typically, the lien holder or creditor who has released the lien is responsible for filing the lien clearance letter in Illinois.

How to fill out lien clearance letter illinois?

To fill out a lien clearance letter in Illinois, include the property owner's name, property description, lien amount, date of release, lien holder's details, and a statement confirming the lien has been satisfied.

What is the purpose of lien clearance letter illinois?

The purpose of a lien clearance letter in Illinois is to provide proof that a lien has been satisfied, which can help property owners clear their title and avoid complications during property transactions.

What information must be reported on lien clearance letter illinois?

A lien clearance letter in Illinois must report the names of the parties involved, a description of the property, the amount of the lien, the date of satisfaction, and the signatory that confirms the lien release.

Fill out your lien release letter form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate Of Release is not the form you're looking for?Search for another form here.

Keywords relevant to how to fill out the that it is completed correctly

Related to lien release form illinois

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.